An ec 10 student brings an article on college tuition to my attention, asking for my commentary. Here are a few thoughts.

An ec 10 student brings an article on college tuition to my attention, asking for my commentary. Here are a few thoughts.1. The student wonders whether the article's claim that college popularity rises with tuition is related to our study of Giffen goods and perversely sloped demand curves. I don't think so. The phenomenon about college popularity, to the extent it exists, does not rely on an odd combination of income and substitution effects but, instead, imperfect information. Consumers may use price to judge quality. Would you choose a surgeon that advertised having the cheapest rates in town?

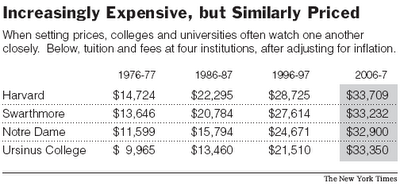

2. Economist William Baumol explained one reason tuition has risen. Consider an industry that uses only labor in production and experiences no technological progress, assumptions that arguably approximate colleges and string quartets. The price of its output will have to grow with the price of labor. The price of labor (the real wage) will, in turn, grow with economy-wide technological progress. Using the numbers in the above table from the Times, one finds that Harvard tuition has grown at 2.8 percent per year (note that this is adjusted for overall inflation). Real GDP per capita grows about 2 percent per year--a rough measure of economy-wide technological change. Thus, much of the increase in tuition, but probably not all, can be explain by the Baumol effect.

3. Over the past thirty years, the college premium has risen substantially. That is, workers with college degrees have enjoyed stronger wage gains than those without--a phenomenon often attributed to skill-biased technological progress. This rising college premium has had two effects on college tuition. First, colleges use a lot of educated labor in producing their output, so their costs have risen faster than they otherwise would. Second, the rising college premium has increased the demand for the services of colleges. Supply shifts left, demand shifts right, and the price unambiguously rises.

4. Colleges have gotten increasingly good at price discriminating. (Recall the discussion of price discrimination in chapter 15 of my favorite economics textbook.) The list price is set high, and then many customers are offered a discount called "financial aid" based on their ability to pay. Here's the secret plan: In the future, Harvard will cost $1 billion a year, and only Bill Gates's children will pay full price. When anyone else walks through the door, the message will be "Special price, just for you."

No comments:

Post a Comment