Sunday, December 31, 2006

Resolutions for Another New Year

Repeat After Me

By N. Gregory Mankiw

The Wall Street Journal, January 3, 2006

CAMBRIDGE, Mass. -- Now is a time when most of us sit back and reflect on the past year and on how to do better in the year ahead. Since I know, however, that economic policy makers inside the Beltway are often too busy for such introspection, my gift to them is a list of seven New Year's resolutions. Any senator, congressman or presidential wannabe is free to adopt them as his or her own. Just repeat after me:

• #1: This year I will be straight about the budget mess. I know that the federal budget is on an unsustainable path. I know that when the baby-boom generation retires and becomes eligible for Social Security and Medicare, all hell is going to break loose. I know that the choices aren't pretty -- either large cuts in promised benefits or taxes vastly higher than anything ever experienced in U.S. history. I am going to admit these facts to the American people, and I am going to say which choice I favor.

• #2: This year I will be unequivocal in my support of free trade. I am going to stop bashing the Chinese for offering bargains to American consumers. I am going to ask the Bush administration to revoke the textile quotas so Americans will find it easier to clothe their families. I am going to vote to repeal the antidumping laws, which only protect powerful domestic industries from foreign competition. I am going to admit that unilateral disarmament in the trade wars would make the U.S. a richer nation.

• #3: This year I will ask farmers to accept the free market. While I believe the government should provide a safety net for the truly needy, taxpayers shouldn't have to finance handouts to farmers, many of whom are wealthy. Farmers should meet the market test as much as anyone else. I will vote to repeal all federal subsidies to growers of corn, wheat, cotton, soybeans and rice. I will vote to allow unrestricted import of sugar. (See resolution no. 2.) I will tell Americans that eliminating our farm subsidies should not be a "concession" made in trade negotiations but a policy change that we affirmatively embrace.

• #4: This year I will admit that there are some good taxes. Everyone hates taxes, but the government needs to fund its operations, and some taxes can actually do some good in the process. I will tell the American people that a higher tax on gasoline is better at encouraging conservation than are heavy-handed CAFE regulations. It would not only encourage people to buy more fuel-efficient cars, but it would encourage them to drive less, such as by living closer to where they work. I will tell people that tolls are a good way to reduce traffic congestion -- and with new technologies they are getting easier to collect. I will advocate a carbon tax as the best way to control global warming. Because we may well need to raise more revenue (see resolution no. 1), I'll always be on the lookout for these good taxes.

• #5: This year I will not be tempted to bash the Fed. Ben Bernanke, soon to be the new chairman of the Federal Reserve, will not inherit Alan Greenspan's halo, and so may be a tempting target. But I will resist temptation. I know that the U.S. has an independent central bank for good reason. I know that sometimes the Fed needs to raise interest rates to fight inflation, even if it risks slowing growth in incomes and employment. I will let Mr. Bernanke and his colleagues do their job. Difficult as it is, I will hold my tongue.

• #6: This year I will vote to eliminate the penny. The purpose of the monetary system is to facilitate exchange, but I have to acknowledge that the penny no longer serves that purpose. When people start leaving a monetary unit at the cash register for the next customer, the unit is too small to be useful. I know that some people will be upset when their favorite aphorisms become anachronistic, but a nickel saved is also a nickel earned.

• #7: This year I will be modest about what government can do. I know that economic prosperity comes not from government programs but from entrepreneurial inspiration. Adam Smith was right when he said, "Little else is required to carry a state to the highest degree of opulence from the lowest barbarism but peace, easy taxes, and a tolerable administration of justice." As a government official, I am not going to promise more than I can deliver. I am going to focus my attention on these three goals -- peace, easy taxes, and a tolerable administration of justice -- and I am going to trust the creativity of the American people to do the rest.

Saturday, December 30, 2006

Ford sums up Hayek

A government big enough to give you everything you want is a government big enough to take from you everything you have.

Chinese Competitors

Well, it turns out, I already do.

Friday, December 29, 2006

Drivers respond to incentives

A nice case study for the Pigou Club files.It would seem intuitive: If gasoline prices become painful enough, people will find ways to cope, such as car-pooling or using mass transit. Now there are statistics to buttress that assumption in at least one respect.

They come in a state Department of Transportation report completed only last month and based upon monitoring of the high-occupancy vehicle lanes on interstates 91, 84 and 384. Those 38 miles of HOV lanes are restricted to vehicles carrying two or more people, and the DOT surveys their usage every year in mid-September.

In 2005, with gas prices at $3.16 a gallon, daily use of the HOV lanes hit an all-time high, about 10,180 people during the morning rush hours.

For anyone who thought those high gasoline prices might lead people to change their commuting habits for the long term, however, the new numbers are disappointing. This September, a year later, with gas prices at $2.77 a gallon, daily usage plummeted to 2004 levels, 8,523 people during the morning rush. On I-91 southbound, 1,324 vehicles carried 3,854 people during the commute to work, representing decreases of 28 percent and 16 percent from the previous year.

"HOV usage does follow pretty closely with the gasoline per-gallon pricing," said Jim Andrini, a transportation supervising planner at the agency.

Some Good Trade News

Here is a previous post on zeroing.In addition to the U.S. International Trade Commission deviating from its conventional script and revoking 15 longstanding antidumping measures on key steel products, the Office of the U.S. Trade Representative announced to Congress the administration’s decision to implement a critical change to the Commerce Department’s antidumping calculation methodology, which, if implemented in good faith, will likely reduce the incidence and disruptive impact of antidumping measures henceforth. In response to a series of rulings from the dispute settlement body of the World Trade Organization, which found a U.S. methodological practice known as “zeroing” to violate Article 2.4.2 of the WTO’s Antidumping Agreement, Commerce decided (albeit, grudgingly) to change it’s policy.

Thursday, December 28, 2006

Universal 401k Accounts

Here is the question I am left with: Is this proposed policy the best way to redistribute income? That is, if Congress were to allocate a certain amount of additional funds to help the poor, would advocates of these accounts, such as Gene Sperling and Peter Orszag, prefer to spend the money on these saving incentives or on, say, an expansion of the Earned Income Tax Credit?

No doubt, they would say that they would prefer to do both. But that answer just brings us back to the old question of how much income redistribution the government should pursue. The more novel question, raised by these proposals, concerns the form of redistribution. That is, holding the amount of income redistribution constant, what is the optimal way to transfer resources to the poor?

Wednesday, December 27, 2006

Milton and Rose

Fear of Asia

From today's Washington Post.I am not an international economist, to say the least. I had to struggle to get through Ec 1 my sophomore year of college. But I am a careful reader of the business and economic reporting of my newspaper, so I think I am qualified to ask two questions -- neither of which are answered in this report -- about those scary folk in south and east Asia.

Question one: Isn't the freedom and flexibility of American culture and politics, not the quality of our educational system, what has given us such power in the world? India appears to have adopted many of those freedoms and its people have a chance to be just as creative as we are. But I have spent much of my life studying China and I don't see any way that country is going to set its great culture free any time soon. The China brain drain will be in our favor until Beijing adopts democracy and human rights, and that will take a long time.

Question two: Even if both India and China do attain that potent blend of liberty and creativity, how exactly is that going to hurt Americans? Their economies are thriving because world commerce is losing its dependence on borders and tariffs, and the old way of thinking (accepted without question in this report) that if some poor countries get rich, then some rich countries, like us, are going to become poor. The experts on these issues that I find most persuasive point out that only countries cut off from the world economy, like North Korea, are declining, and that is because they are not globalized. Everyone else is discovering that the better off India and China and El Salvador and Tanzania become, the better off we all are. The more middle-class people overseas, the more customers there will be for the newest gizmos that our large and innovative middle-class country keeps coming up with.

Tragedy of the Bunnies

Tuesday, December 26, 2006

Working at Cross Purposes

1. A wage subsidy for unskilled workers, paid for by

2. A tax on employers who hire unskilled workers.

Now, if you think like an economist, you might wonder about the logic of part 2 of this proposal. You might say, "A tax on the hiring of unskilled workers would discourage their employment, offsetting some of the benefits they would get from the wage subsidy. It would be better to finance the wage subsidy with a more general tax, rather than with a tax targeted specifically on employers of unskilled workers."

I agree. So why did I bring up this proposal? Because a policy essentially the same looks likely to become law, having been advocated by Congressional leaders and, recently at his news conference, President Bush. Haven't heard of it? It is called an increase in the minimum wage.

------

Update: A commenter asked about the technical equivalence of minimum wages with taxes and subsidies. I will leave this issue as an exercise for the reader, but here are some hints about how to think about it in a competitive labor market using supply and demand curves. Let w be the market wage, and let W be the target wage of policymakers. Draw supply and demand curves for labor such that the equilibrium wage in the absence of any policy is below W. Now suppose the government tells suppliers of labor: Whenever w is less than W, you are paid a subsidy equal to W-w. Similarly, it tells demanders of labor: Whenever w is less than W, you are charged a tax equal to W-w. Calculate quantity supplied and quantity demanded as a function of the market wage w. Graph the new supply and demand curves, and I believe the equivalence should be clear.

Monday, December 25, 2006

A Christmas Reading List

- A defense of Ebenezer Scrooge.

- The deadweight loss of Christmas.

- A targeted tax credit for Christmas presents.

Merry Christmas, everyone!

Sunday, December 24, 2006

The Economics of Gifts

Case Study

Gifts as Signals

A man is debating what to give his girlfriend for her birthday. "I know," he says to himself, "I'll give her cash. After all, I don't know her tastes as well as she does, and with cash, she can buy anything she wants." But when he hands her the money, she is offended. Convinced he doesn't really love her, she breaks off the relationship.

What's the economics behind this story?

In some ways, gift giving is a strange custom. As the man in our story suggests, people typically know their own preferences better than others do, so we might expect everyone to prefer cash to in-kind transfers. If your employer substituted merchandise of his choosing for your paycheck, you would likely object to the means of payment. But your reaction is very different when someone who (you hope) loves you does the same thing.

One interpretation of gift giving is that it reflects asymmetric information and signaling. The man in our story has private information that the girlfriend would like to know: Does he really love her? Choosing a good gift for her is a signal of his love. Certainly, the act of picking out a gift, rather than giving cash, has the right characteristics to be a signal. It is costly (it takes time), and its cost depends on private information (how much he loves her). If he really loves her, choosing a good gift is easy because he is thinking about her all the time. If he doesn't love her, finding the right gift is more difficult. Thus, giving a gift that suits the girlfriend is one way for him to convey the private information of his love for her. Giving cash shows that he isn't even bothering to try.

The signaling theory of gift giving is consistent with another observation: People care most about the custom when the strength of affection is most in question. Thus, giving cash to a girlfriend or boyfriend is usually a bad move. But when college students receive a check from their parents, they are less often offended. The parents' love is less likely to be in doubt, so the recipient probably won't interpret the cash gift as a signal of lack of affection.

Saturday, December 23, 2006

What changed?

At the turn of the 20th century, child labor was common; working conditions were often abysmal; there were no enforced workplace health, safety or environmental requirements; no unemployment insurance; and no workers' compensation. Workers were attacked and killed for the sole reason that they wanted to form a union; there was no 40-hour week, minimum wage, job security, overtime pay or virtually any other limit on the exploitation of employees. America was split dramatically between the haves and have-nots. It was a harsh work world for many: nasty, brutish and, too often, short. Worker activism, new laws and court decisions changed all that during the past century.That last sentence is striking. There is no doubt that most Americans have seen dramatic improvements in living standards and workplace norms over the past century. But should we really give most of the credit to "worker activism, new laws and court decisions?" I don't think so.

I would give most credit to economic growth, which in turn is driven by technological progress, a market system, and a culture of entrepreneurship. As the economy grows, the demand for labor grows, and workers achieve better wages and working conditions.

Economic studies of unions, for example, find that unionized workers earn about 10 to 20 percent more by virtue of collective bargaining. By contrast, real wages and income per person over the past century have increased several hundred percent, thanks to advances in productivity.

Similarly, working conditions are poor in less developed countries today because productivity is low there. The key to improving lives in those nations is economic growth, not "worker activism, new laws and court decisions."

Warning: Advertisement

From my inbox this morning:

From my inbox this morning:Hi,

I have recently just finished taking a Microeconomics course, at Thomas Edison State College, that employed the use of your text book. I spent countless hours reading your textbook... However, it was quite beneficial for me to do so (the countless hours... opportunity costs!).

I am most definitely not in the habit of writing to text book authors (usually, I consider them to be my nemesis!). However, your textbook was absolutely outstanding. The chapters are short and right to the point. It does have case studies and examples for all those interested. It is written very well. The tone assumes that the reader is unfamiliar with economics and that was definitely my case. All of your examples were interesting and useful.

Most importantly, I've never thrown your textbook across the room... A first for me! (I'm not violent or anything... just a bad habit...)

Friday, December 22, 2006

Krugman on the Deficit

Democrats shouldn't worry too much about the budget deficit. Yes, ideally it would be smaller, but given political reality, deficit reduction should not be the first priority. Any attempt to reduce the deficit will only end up giving the other party more opportunity to pursue unjustifiable tax cuts. The best way to help the American people would be to worry later about the looming fiscal gap and focus now on desirable spending increases.I know some policy wonks from the right-realpolitik camp on economic policy with a similar view:

Republicans shouldn't worry too much about the budget deficit. Yes, ideally it would be smaller, but given political reality, deficit reduction should not be the first priority. Any attempt to reduce the deficit will only end up giving the other party more opportunity to pursue unjustifiable spending increases. The best way to help the American people would be to worry later about the looming fiscal gap and focus now on desirable tax cuts.Alberto Alesina and Allan Drazen once modelled this phenomenon as a war of attrition.

If Paul and his conservative counterparts get their way, then at least for now we won't see a grand bargain between the parties of the sort I described in this WSJ op-ed earlier in the year. Maybe I was just dreaming.

Offshore

Does work that you knowI received this alternative rendition of the song from billionaire Sam Zell when I was CEA Chair. (See Zell's current holiday greeting in my previous post.) The song came as part of an odd globe-like object. When you pressed a button on the base, the globe spun and increasingly cities around the world started lighting up, while the above song played.

Seem like it's suddenly flowing

To some parts unknown?

Offshore.

Are you getting worried

While your programming hurries

To a new time zone?

Offshore.

Is it a sucking sound we're hearing?

Is our edge now disappearing?

Can we survive when Asia thrives

On outsourcing our coat strings?

Stop now and think.

The lock's off Pandora's box

Now that the whole world is wired

Can't turn back the clock

We go Offshore...plants are much cheaper there

Offshore...workers delighted there

Offshore...our cost center's waiting there

Offshore..

Offshore.

The voice on the phone

Knows all the team scores at home

Though he's in Bangalore

Offshore...

Must we get frightened

When cheap labor's enlightened?

Have we sold the store?

Offshore...

Au contraire--production's where

It can be most efficient

Our advantage lies to utilize

The global market system

The tide lifts all boats..

It's time to go blaze the trail

We need to master the structure

Think on a new scale

And go

Offshore...Technology's moved the bar

Offshore...Don't wait a minute more

Offshore...Adapt to the future for

Offshore..

Offshore.

Offshore.

To make the world a safer place

Our thinking must be global.

Let's create-not legislate

And let the unseen hand go

Guide things along.

We hope that we'll see you then

As living standards get better

We'll all prosper when

We go

Offshore...

Our key is to innovate

Offshore...

Profits to generate

Offshore...

And now we must go for trade...offshore.

Of course, as a federal official, I was not allowed to receive gifts. So the object was sent to the White House gifts office, which said I could keep it only if I compensated Mr Zell for the appraised value, which I did. It was the only time in my life that I sent a personal check to a billionaire. Mr Zell wrote back, saying he applied the funds to a charity.

The globe is one of my favorite souvenirs from my time in Washington, in part because I have long been a Petula Clark fan.

Thursday, December 21, 2006

Deval Patrick is no Pigovian

Okay, let me get this straight: It is important that we reduce our consumption of oil. Therefore, we should not tax it.GAS TAX HIKE CLASHES WITH TRANSPORTATION, ENERGY GOALS, PATRICK SAYS

By Michael P. Norton and Jim O'Sullivan

STATE HOUSE NEWS SERVICE

BOSTON, WEDNESDAY, DEC. 20, 2006Raising the gas tax, an idea contemplated by a state commission eyeing ways to address a huge backlog in transportation maintenance problems, runs counter to the push for energy efficiency and independence, according to Gov.-elect Deval Patrick, who nonetheless backed off a campaign pledge against such an increase.

"We need to be much, much more efficient in the use of hydrocarbons for energy reasons, for reasons of independence, for reasons of our dependence on foreign oil and gas, on hydrocarbons generally," Patrick told the News Service during an interview at the waterfront law office he is using as a staging area for his administration, which moves into power on Beacon Hill in two weeks.

"If we're trying to cultivate here in Massachusetts an energy-smart economy, then the notion of relying for additional revenues on something we're trying to break our dependence on doesn't seem to me to be a formula for long-term success."

Hmmm....Governor Patrick was Harvard class of 1978, and it's a good bet that he took ec 10. I wonder what they taught about the slope of demand curves back then.

Wednesday, December 20, 2006

Not to my face, they don't

his students affectionally refer to him as "N-dot".I have heard that nickname before, but I am surprised to learn that it has gained some currency.

Update: Gzkn writes in the comments section, "As a regular Wikipedia editor (and reader of this blog), I've taken the liberty of removing the "N-dot" reference from the article, since it's not exactly backed up by reliable sources."

Update 2: Also from the comments section: "From an ec10 instructor who works for N-Dot, His students DO call him that, and they also chuckle when they walk past his car with the EC10 license plate. So, to the wikipedia editor, please, put it back in."

Expectant parents respond to incentives

about 5,000 babies, of the 70,000 or so who would otherwise be born during the first week in January, may have their arrival dates accelerated partly for tax reasons.

Here is a previous post describing how it works in the southern hemisphere.

Tuesday, December 19, 2006

Does econ make people conservative?

As a Princeton grad myself, I have full confidence in your teacher. Putting that issue aside, let me address your central question: Does the study of economics tend to make people conservative?Dear Mr. Mankiw,

I wanted to write to tell you how much I enjoy reading your economics blog. Compounded with my class' usage of your textbook, learning economics feels like a very interactive process. Thanks to your work and my teacher (he's from Princeton, not Harvard, but still a good teacher), I've taken a very genuine interest in economics.

I had a question though. My school offers two main elective history courses for seniors: Government and Economics. Due to scheduling limitations, not many kids are able to take both. I've noticed something interesting as the year has progressed. The students who are taking the government course are increasingly endorsing leftist ideologies while the economics students are becoming increasingly right wing. For instance, my school's paper recently ran an editorial that 'complained' that too many of Lawrenceville's finest were going into investment banking, and not into seemingly 'socially beneficial' careers. What is your view on government intervention on economic equality and the like? Do all economics students show republican (or right of center) tendencies?

Thanks,

[name withheld]

The Lawrenceville School

Princeton, NJ

I believe the answer is, to some degree, yes. My experience is that many students find that their views become somewhat more conservative after studying economics. There are at least three, related reasons.

First, in some cases, students start off with utopian views of public policy, where a benevolent government can fix all problems. One of the first lessons of economics is that life is full of tradeoffs. That insight, completely absorbed, makes many utopian visions less attractive. Once you recognize, for example, that there is a tradeoff between equality and efficiency, as economist Arthur Okun famously noted, many public policy decisions become harder.

Second, some of the striking insights of economics make one more respectful of the market as a mechanism for coordinating a society. Because market participants are motivated by self-interest, a person might naturally be suspect of market-based societies. But after learning about the gains from trade, the invisible hand, and the efficiency of market equilibrium, one starts to approach the market with a degree of admiration and, indeed, awe.

Third, the study of actual public policy makes students recognize that political reality often deviates from their idealistic hopes. Much income redistribution, for example, is aimed not toward the needy but toward those with political clout. This Dave Barry column, which is reprinted in Chapter 22 of my favorite economics textbook, describes a good example.

For these three reasons, many students in introductory economics courses become more conservative--or, to be precise, more classically liberal--than they began. Nonetheless, studying economics does not by itself determine one's political ideology. I know good economists who are distinctly right of center and good economists who are distinctly left of center. In my department at Harvard, I would guess that Democrats outnumber Republicans among the faculty (although there is surely more political balance in the economics department than in most other departments at the university).

Monday, December 18, 2006

Mallaby on Hedge Funds

By identifying irrational prices and correcting them, hedge funds promote the allocation of the world's capital to the countries, companies and individuals that will use it best.We will discuss the role of financial markets and institutions in ec 10 during the spring semester.

Sunday, December 17, 2006

Spring Line-up

The Newest Hamiltonian

I once heard a colleague opine, "A good student is worth a paper and a half." Jason is worth one and three-quarters.Hamiltonian Democrats’ Get New Leader

Former Clinton administration economist Jason Furman will become the new director of The Hamilton Project, a year-old effort of the Brookings Institution to promote a centrist economic strategy. Named for Alexander Hamilton, the nation’s first Treasury secretary, the project is better known for its association with his modern successor, Clinton Treasury Secretary Robert Rubin, a founder and funder....

In the Clinton White House, Furman was a top staffer for budget and tax issues. He also was an economist at the World Bank and in 2004 was director of economic policy for Sen. John Kerry’s presidential campaign. He received his doctorate in economics from Harvard University, under the supervision of N. Gregory Mankiw, who went on to be a top economic adviser to President Bush.

Rumor Mill

Saturday, December 16, 2006

Tax Competition and the Core of Justice

There is a problem with tax competition, when people get away from high-tax regions and move to low-tax regions to maximize their own utility function....If there's no obstacle in politics and regional boundaries, and people could establish a new local governments freely, does there possibly exist an optimal government structure?Let me put the question this way: If we built a model of pure tax competition, where any individual or group of individuals were free to opt out of a society to start their own, what would the equilibrium look like? And does that equilibrium have anything to commend it?

I don't know of work in this area (although that may reflect my ignorance rather than a hole in the literature). Here are some thoughts on the topic.

There is an old concept in cooperative game theory called the core, which wikipedia defines as follows:

That seems to be the right concept for a pure theory of tax competition.The core of a game is a set of vectors allocating payoffs to players, which preserve the following conditions:

- Efficiency: it is assumed that the players form the grand coalition (a coalition containing all players), and so the sum of individual payoffs should equal the value of the grand coalition.

- Strategic stability or balance: no coalition can earn more by defecting from the grand coalition. E.g. no coalition has a value greater than the sum of its members' payoffs.

What do we know about the core as applied to economic situations? A classic paper by Herbert Scarf ("An Analysis of Markets with a Large Number of Participants", 1962, Recent Advances in Game Theory) showed that the core of economies with large numbers of people converges to the set of competitive equilibria. See also Debreu and Scarf. This core-convergence theorem, sometimes called the Edgeworth conjecture, is often interpreted as showing why competitive equilibria are the natural outcomes even if there is no Walrasian auctioneer calling out prices to balance supply and demand in all markets. In a sense, it gives a bargaining interpretation to the Walrasian equilibria.

Let me give this result an interpretation beyond what Scarf suggested: If we take it as an axiom of justice that people should be free to leave a society, either as individuals or in groups, then the competitive equilibrium is not only efficient but it is also just. In some sense, the core provides an axiomatic basis for the libertarian embrace of competitive market outcomes and rejection of income redistribution (but not completely--see below).

Scarf examined classical exchange economies without pure public goods. Maybe someone has extended this work to the provision and financing of public goods, but I have not seen it. Here is a guess: Under the core concept, taxes would have be set according to the benefits principles. That is, people would pay taxes to fund public goods based on the benefit they receive from those goods. Taxes can rise with income: You can get a rich person to pay more for, say, national defense because he gets greater benefit from it than a poor person does. Progressive taxation would arise if and only if the income elasticity of the demand for public goods were greater than one.

Now let's reconsider income redistribution. Must income redistribution disappear in this world where the core is the accepted concept of justice? Not necessarily. In this case, income redistribution would be possible if those funding the transfer system valued income distribution as a pure public good, as Lester Thurow has suggested. But the argument for redistribution is very different than the utilitarian calculus often used.

Utilitarians are comfortable taking from the rich to give to the poor simply because of diminishing marginal utility. They have problems with people like Mr Hallyday who choose to opt out. For a utilitarian to implement his plan, he has to restrict Mr Hallyday's freedom to exit the system. By contrast, if we grant the premise that no one should be compelled to remain in a society, then people pay taxes to the government only insofar as they get benefits from the government. The resulting theory of distributive justice looks more libertarian than utilitarian.

Friday, December 15, 2006

The French are people too

French rocker Johnny Hallyday, one of France's biggest showbusiness stars and a high profile supporter of presidential hopeful Nicolas Sarkozy, said on Thursday he was moving to Switzerland to escape French taxes.

"Like a lot of French people, I'm sick of what they make us pay in taxes," the singer told Europe 1 radio on Thursday, a day after his impending departure for Switzerland was first reported by the weekly L'Express....

[Prime Minister] Villepin's government has reduced the top income tax bracket to 40 percent but has maintained a wealth tax on people who have assets worth 750,000 euros ($990,500) or more.

Bernanke to China: Stop Saving

The positive economics here is impeccable, but the normative economics is open to debate.Today, about half of China's GDP is devoted to investment and to producing net exports for the rest of the world, and thus only the remaining half is available for consumption, including government consumption. In particular, household consumption in China last year was only 38 percent of GDP, down from 45 percent in 2001. In comparison, household consumption was about 60 percent of GDP in India in 2004, according to the most recent available data. China's low share of consumption in GDP is, of course, the counterpart of its high national saving rate.

Policies aimed at increasing household consumption would clearly benefit the Chinese people, notably by improving standards of living and allowing the fruits of economic development to be shared more widely. Such policies, by reducing saving and increasing imports, would also serve to reduce China's current account and trade surpluses.

If a friend of yours is saving a high fraction of his income, how can you tell him he is saving too much without knowing his personal rate of time preference and his desire for precautionary savings? Judging another person's saving rate is difficult. Judging another nation's saving rate cannot be any easier.

Shaken, not stirred

Thursday, December 14, 2006

Books for Holiday Gifts

If your special econonerd has read all those, then maybe it's time for some works of fiction of the noneconomic variety. Here are a few of my favorites, which are good reading even for the econ-averse:

- "The Curious Incident of the Dog in the Night-Time" by Mark Haddon

- "The Mind-Body Problem" by Rebecca Goldstein

- "Interpreter of Maladies" by Jhumpa Lahiri

- "Crossing to Safety" by Wallace Earle Stegner

- "Happenstance: Two Novels in One About a Marriage in Transition" by Carol Shields

Inequality Wars

Along the same lines, these data from Diana Furchtgott-Roth (Table D) show little change in consumption inequality from 1985 to 2005, a result that reminds me of earlier claims of Dirk Krueger and Fabrizio Perri. By contrast, Jared Bernstein and Jason Furman and Paul Krugman paint a very different picture.As was well-documented years ago by economists Roger Gordon and Joel Slemrod, a great deal of the apparent increase in reported high incomes has been due to "tax shifting." That is, lower individual tax rates induced thousands of businesses to shift from filing under the corporate tax system to filing under the individual tax system, often as limited liability companies or Subchapter S corporations.

IRS economist Kelly Luttrell explained that, "The long-term growth of S-corporation returns was encouraged by four legislative acts: the Tax Reform Act of 1986, the Revenue Reconciliation Act of 1990, the Revenue Reconciliation Act of 1993, and the Small Business Protection Act of 1996. Filings of S-corporation returns have increased at an annual rate of nearly 9.0% since the enactment of the Tax Reform Act of 1986."

Switching income from corporate tax returns to individual returns did not make the rich any richer. Yet it caused a growing share of business owners' income to be newly recorded as "individual income" in the Piketty-Saez and Congressional Budget Office studies that rely on a sample of individual income tax returns. Aside from business income, the top 1%'s share of personal income from 2002 to 2004 was just 7.2% -- the same as it was in 1988.

In short, income shifting has exaggerated the growth of top incomes.

Even as an economic data geek (but not one who specializes in studying inequality), I have a hard time sorting out the competing claims in this literature.

Update: Another piece of this puzzle is a paper by Kopczuk and Saez on wealth inequality. They find (see figures 2 and 5) that wealth concentration has not changed much over the past half century (although their data end in 2000), and it is nowhere near the levels experienced in the 1920s.

Wednesday, December 13, 2006

Equilibrium Exploitation

Update: Their sex lives will suffer too.

The Objectivity of Academia

Faculty with earlier surname initials are significantly more likely to receive tenure at top ten economics departments, are significantly more likely to become fellows of the Econometric Society, and, to a lesser extent, are more likely to receive the Clark Medal and the Nobel Prize.From a recent paper by Liran Einav and Leeat Yariv.

From now on, I will use the name N. Gregory Aaamankiw.

On College Tuition

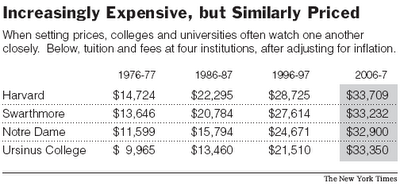

An ec 10 student brings an article on college tuition to my attention, asking for my commentary. Here are a few thoughts.

An ec 10 student brings an article on college tuition to my attention, asking for my commentary. Here are a few thoughts.1. The student wonders whether the article's claim that college popularity rises with tuition is related to our study of Giffen goods and perversely sloped demand curves. I don't think so. The phenomenon about college popularity, to the extent it exists, does not rely on an odd combination of income and substitution effects but, instead, imperfect information. Consumers may use price to judge quality. Would you choose a surgeon that advertised having the cheapest rates in town?

2. Economist William Baumol explained one reason tuition has risen. Consider an industry that uses only labor in production and experiences no technological progress, assumptions that arguably approximate colleges and string quartets. The price of its output will have to grow with the price of labor. The price of labor (the real wage) will, in turn, grow with economy-wide technological progress. Using the numbers in the above table from the Times, one finds that Harvard tuition has grown at 2.8 percent per year (note that this is adjusted for overall inflation). Real GDP per capita grows about 2 percent per year--a rough measure of economy-wide technological change. Thus, much of the increase in tuition, but probably not all, can be explain by the Baumol effect.

3. Over the past thirty years, the college premium has risen substantially. That is, workers with college degrees have enjoyed stronger wage gains than those without--a phenomenon often attributed to skill-biased technological progress. This rising college premium has had two effects on college tuition. First, colleges use a lot of educated labor in producing their output, so their costs have risen faster than they otherwise would. Second, the rising college premium has increased the demand for the services of colleges. Supply shifts left, demand shifts right, and the price unambiguously rises.

4. Colleges have gotten increasingly good at price discriminating. (Recall the discussion of price discrimination in chapter 15 of my favorite economics textbook.) The list price is set high, and then many customers are offered a discount called "financial aid" based on their ability to pay. Here's the secret plan: In the future, Harvard will cost $1 billion a year, and only Bill Gates's children will pay full price. When anyone else walks through the door, the message will be "Special price, just for you."

Tuesday, December 12, 2006

Answer from Ed Prescott

I have not processed all this sufficiently to say that I fully understand it, but this note certainly goes a long way toward clarifying Ed's thinking for me. I greatly appreciate his taking the time to write.Greg,

Kathryn Birkeland and I come to our conclusions using a calibrated OLG model. Crucial is the length of the retirement period and the population growth rate. Bob Fogel is confidently predicting longer retirement periods because of a projected decreases in morbidity. He convinced us. Our expected length of lives is low if anything.

The U.S. economy has been growing at 3% and the average return on capital has been 4% (See McGrattan and Prescott, AER Papers and Proceedings, May 2003). Birkeland and I have people beginning to work at 21 and continuing to work until they are 65, which is higher than the median retirement age in the United States. Model people die when they are 85. Productivity grows at 2%, population grows at 1%, and people discount at rate 1%. Consequently all ages at a point in time consume the same amount and the households face a 4% real interest rate.

We know there is no competitive equilibrium for the Diamond (1965) economy unless government debt is (or alternatively the size of taxes and transfers are) such that the interest rate is above the economy’s growth rate. It is true that with land that does not depreciate and provides a service, there always is an equilibrium and it is efficient. But even land requires some maintenance and land is taxed. We restricted attention to policies for which an equilibrium exists and the equilibrium interest rate is 1% above the sum of population growth rate and productivity growth (labor augmenting) rate.

The important point of our analysis is that it is welfare improving to have government debt rather than taxing the labor income of the workers and making transfers to the retirees where both policies are such that the real interest rate is 4%. The latter policy has much lower government debt though the present value of government promises is large. Making these liabilities explicit and shifting to a saving for retirement system improves the welfare of all except retirees, whose welfare is unchanged. The resulting large increase in government debt is not a burden on our grandchildren. The tax and transfer system to finance retirement consumption is a burden because workers value leisure.

EdP.S. We did not argue that the U.S. economy is dynamically inefficient, so our results do not contradict the finding in Abel, et al.

Update: On reflection, I am inclined to interpret Ed as saying he is worried that, absent government debt (or social security), the economy would oversave and end up dynamically inefficient, a situation characterized by a real interest rate less than the growth rate and a capital stock greater than Phelps's Golden Rule level. This outcome is a theoretical possibility, but I am skeptical that it is in fact the case for the U.S. economy.

I don't know of a link to the research paper Ed mentions, but if I find one, I will post it.

Update 2: Click here.

Tax rates, Risk-taking, and Inequality

The above graph (source) shows the top marginal tax rate under the U.S. income tax. One striking feature is the substantial decline over the past several decades.

The above graph (source) shows the top marginal tax rate under the U.S. income tax. One striking feature is the substantial decline over the past several decades.I present this graph as background for Richard Posner's thoughts about rising income inequality:

Has the fall in top marginal tax rates over the past several decades in fact encouraged people to pursue higher-risk career paths, thereby exacerbating inequality in ex post incomes? As far as I know, this hypothesis has not received much attention in the empirical literature on income inequality.There are now almost 800 billionaires in the United States and countless millionaires, and one out of every 500 U.S. households have an annual income of at least $1 million.

Now this is to look only at the top of the income distribution. It is not to consider the income distribution as a whole, let alone poverty. In the more conventional focus on earnings by quintiles, one sees little change in recent years. But since 1980 the percentage of total personal income going to the top 1 percent of earners has risen from 8 percent to 16 percent. It is the top of the distribution on which I’ll be focusing.

What are the causes, and what are the effects, of this trend in the income (and of course wealth) of the highest-earning segment of the distribution? Part of it is reduced marginal tax rates, because high marginal tax rates discourage risk-taking. Consider two individuals: one is a salaried worker with an annual income of $100,000 and good job security, and the other is an entrepreneur with a 10 percent chance of earning $1 million in a given year and a 90 percent chance of earning nothing that year. Their average annual incomes are the same, but a highly progressive tax will make the entrepreneur's expected after-tax income much lower than the salaried worker's. Many of the people at the top of the income distribution are risk takers who turned out to be lucky; the unlucky risk takers fell into a lower part of the distribution.

Monday, December 11, 2006

Now I am confused

Usually, even when I disagree with a fellow economist, I can understand his point of view. But I am puzzled about this passage. Ed must have some model in mind, but I am not sure what it is.Myth No. 5: Government debt is a burden on our grandchildren. There's no better way to get people worked up about something than to call on their sympathies for their beloved grandkids. The last thing that I want to do is to burden my own grandchildren with the sins of profligacy. But we should stop feeling guilty -- at least about government debt -- because we are in better shape than conventional wisdom suggests.

Theory and practice tell us that the optimal amount of public debt that maximizes the welfare of new generations of entrants into the workforce is two times gross national income, or GDP. This assumes 1% population growth, 2% productivity growth, 4% real after-tax return on investments, and that people work to age 63 and live to age 85. Currently, privately held public debt is about 0.3 times GDP, and if we include our Social Security obligations, it is 1.6 times GDP. In either case, we could argue that we have too little debt.

What's going on here? There are not enough productive assets -- tangible and intangible assets alike -- to meet the investment needs of our forthcoming retirees. The problem is that the rate of return on investment -- creating more productive assets -- decreases as the stock of these assets increases. An excessive stock of these productive assets leads to inefficiencies.

Total savings by everyone is equal to the sum of productive assets and government debt, and if there is an imbalance in this equation it does not mean we have too little or too many productive assets. The fix comes from getting the proper amount of government debt. When people did not enjoy long retirements and population growth was rapid, the optimal amount of government debt was zero. However, the world has changed, and we in fact require some government debt if we care about our grandchildren and their grandchildren.

If we should worry about our grandchildren, we shouldn't about the amount of debt we are leaving them. We may even have to increase that debt a bit to ensure that we are adequately prepared for our own retirements.

To some degree, it sounds like Ed is worried that the U.S. economy might accumulate more capital than what Ned Phelps called the "Golden Rule" level. As I discuss in my intermediate macroeconomics textbook, Phelps used a Solow growth model to show that an economy can potentially save beyond the point that maximizes steady-state consumption. Peter Diamond subsequently showed that such excessive saving can arise even when overlapping generations of consumers make individually optimal saving decisions. This situation is sometimes called "dynamic inefficiency." When an economy is dynamically inefficient, government debt can have the virtue of depressing the capital stock toward its optimal level.

Andy Abel, Larry Summers, Richard Zeckhauser, and I once wrote a paper on this topic. We concluded that while dynamic inefficiency is possible in theory, it is not a problem in practice. Is Ed now coming to the opposite conclusion, or does he have something entirely different in mind? I am not sure.

Update: Click here.

Summers vs Baker

At the top of my list is free trade -- trade policies that would make it as easy for hospitals and law firms to hire doctors and lawyers from India and China as it is for Wal-Mart to buy cheap shoes from the developing world.

Sunday, December 10, 2006

The Peltzman Effect

My advice to students navigating Harvard square: Walk.

Laibson x 2

We're from the government and we are here to help you

As you might guess, the story does not end well for Mr Hettinga. But I much appreciated his grace in defeat:In the summer of 2003, shoppers in Southern California began getting a break on the price of milk.

A maverick dairyman named Hein Hettinga started bottling his own milk and selling it for as much as 20 cents a gallon less than the competition, exercising his right to work outside the rigid system that has controlled U.S. milk production for almost 70 years. Soon the effects were rippling through the state, helping to hold down retail prices at supermarkets and warehouse stores.

That was when a coalition of giant milk companies and dairies, along with their congressional allies, decided to crush Hettinga's initiative. For three years, the milk lobby spent millions of dollars on lobbying and campaign contributions and made deals with lawmakers, including incoming Senate Majority Leader Harry M. Reid (D-Nev.).

"I still think this is a great country," Hettinga said. "In Mexico, they would have just shot me."

People Skills

Saturday, December 9, 2006

Stavins in the Club

Tragicomic Mathematics

The Education of Clive Crook

I started out loathing the man (or what I thought he stood for) and ended up idolizing him.Can you guess who he is talking about?

Pigovian Questions

Does the Club support Pigouvian taxes irrespective of the use of the tax revenues. Ideally, the revenues would be used to offset distortionary taxes (such as on labor or saving). But what about other uses, such as debt reduction? More problematic is if the revenue is used strictly to increase government spending. There's clearly a time-inconsistency problem here, but the Club may want to advocate an explicit linking of the Pigouvian tax to offsetting tax reductions.Thanks, Ted. Here is my view on these issues:

On a related point, how strongly does the Club oppose a policy that re-distributes the revenue to the regulated entities. This is a bigger issue with respect to cap-and-trade programs (a form of Pigouvian taxes), in that the common practice thus far has been to allocate the permits to the regulated entities for free, rather than to auction them (as most economists prefer).

The Pigou Club wants to move beyond the rhetorical syllogism, all too common in Republican circles, that

1. Taxes are bad.

2. Pigovian taxes are taxes.

3. Pigovian taxes are bad.

Such a simplistic mindset makes it impossible for people to discuss in a responsible way the relative merits of different tax systems. Instead, we Pigovians acknowledge:

1. There will be some government spending.

2. This spending will be funded with taxes.

3. Government should use the least bad taxes it has available.

In fact, Pigovian taxes are not only least bad--they are good. They correct market failures when transactions costs are too high to expect the forces of the Coase theorem to fix the problem. Pigovian taxes allow truly distortionary taxes, either now or (through debt reduction) in the future, to be lower than they would otherwise be. And in the off-chance that we achieve libertarian utopia and reduce government spending below the level of revenue raised by optimal Pigovian taxation, the extra revenue can always be rebated lump-sum to the public.

I am less fond of cap-and-trade programs than Pigovian taxes because they, in essence, give the revenue from a Pigovian tax lump-sum to a regulated entity. Why should an electric utility, for example, be given a valuable resource simply because it has for years polluted the environment? That does not strike me as equitable. A new firm entering the market should not have to pay for something that an incumbent gets for free. And the fact that the incumbent has for years been taking a valuable resource from the rest of society is no reason to think it deserves a free ride in the future. On equity grounds, one could just as easily argue that the incumbents should compensate society for their past misdeeds.

Cap-and-trade systems are also relatively inefficient, for two reasons. First, they encourage utilities to pollute more before the cap-and-trade system is put into effect in order to "earn" pollution rights. Second, they waste the opportunity to use the Pigovian tax revenue to reduce distortionary taxes on labor and capital. Of course, cap-and-trade systems are better than heavy-handed regulatory systems. But they are not as desirable, in my view, as Pigovian taxes coupled with reductions in other taxes. One exception: If the pollution rights are auctioned off rather than handed out, then cap-and-trade systems are almost identical to Pigovian taxes, including all the desirable efficiency properties.

Pigovians have no magic bullet to keep down government spending. Like many others, I believe that government spending is too high. But Pigovians need not be united about this. The key thing that unites us is the belief that whatever government spending is done, the tax revenue to pay for that spending should be raised in a way that does the least harm or, better yet, the most good.

Friday, December 8, 2006

Marron on the Fiscal Gap

Two Steves

Tim Harford signs up

Consider the problem of climate change: a centralised regulatory approach here would be a catastrophe, lashing out at easy political targets such as SUVs or cheap airline travel. But pure laissez-faire will not save the planet either. A predictable tax on carbon would unleash a lot of world-saving creativity at minimum cost.By the way, the Club now has its own Wikipedia entry.

Wage Growth

Thursday, December 7, 2006

New Boss at CBO?

FORMER CLINTON ADVISER Peter Orszag is a prime candidate to head Congressional Budget Office under Democrats. Orszag has been working with former Treasury Secretary Rubin on the Hamilton Project to develop centrist Democratic economic policies.As I noted in a recent post, among serious economists (a group which most definitely includes Peter), there is a range of views about how distortionary high tax rates are. You can read Peter's views in his congressional testimony, but this sentence from it pretty much sums up his perspective:

"Regardless of whether a substantial focus on marginal tax rates may have been appropriate when such rates were 70 percent or higher, that day has long passed, and therefore such a focus is no longer relevant."For the opposite view, see Ed Prescott.

Update: Peter's appointment is official.

Supply-side Economics

Dear Prof. Mankiw-

I'm a long-time reader of your blog, a teacher of econ at a private school in Buffalo, and a bit confused about the degree to which economists agree about the real world validity of supply-side theory. I seem to remember Krugman or Frank Rich declaring that supply-side had basically been discredited. Is this so? Are there many or any widely-respected supply-siders in the academe? Thanks in advance for any time you may have to respond. Even a citation for an article or two would be a great help.

Best,

[name withheld]

Upper School History Teacher

Here is what I write about supply-side economics in Chapter 8 of my principles textbook:

The Laffer Curve and Supply-Side EconomicsOne day in 1974, economist Arthur Laffer sat in a Washington restaurant with some prominent journalists and politicians. He took out a napkin and drew a figure on it to show how tax rates affect tax revenue. It looked much like panel (e) of our Figure 6. Laffer then suggested that the United States was on the downward-sloping side of this curve. Tax rates were so high, he argued, that reducing them would actually raise tax revenue.

Most economists were skeptical of Laffer's suggestion. The idea that a cut in tax rates could raise tax revenue was correct as a matter of economic theory, but there was more doubt about whether it would do so in practice. There was little evidence for Laffer's view that U.S. tax rates had in fact reached such extreme levels.

Nonetheless, the Laffer curve (as it became known) captured the imagination of Ronald Reagan. David Stockman, budget director in the first Reagan administration, offers the following story:

[Reagan] had once been on the Laffer curve himself. "I came into the Big Money making pictures during World War II," he would always say. At that time the wartime income surtax hit 90 percent. "You could only make four pictures and then you were in the top bracket," he would continue. "So we all quit working after four pictures and went off to the country." High tax rates caused less work. Low tax rates caused more. His experience proved it.When Reagan ran for president in 1980, he made cutting taxes part of his platform. Reagan argued that taxes were so high that they were discouraging hard work. He argued that lower taxes would give people the proper incentive to work, which would raise economic well-being and perhaps even tax revenue. Because the cut in tax rates was intended to encourage people to increase the quantity of labor they supplied, the views of Laffer and Reagan became known as supply-side economics.

Economists continue to debate Laffer's argument. Many believe that subsequent history refuted Laffer's conjecture that lower tax rates would raise tax revenue. Yet because history is open to alternative interpretations, other economists view the events of the 1980s as more favorable to the supply siders.

Some economists take an intermediate position. They believe that while an overall cut in tax rates normally reduces revenue, some taxpayers at some times may find themselves on the wrong side of the Laffer curve. Other things equal, a tax cut is more likely to raise tax revenue if the cut applies to those taxpayers facing the highest tax rates. In addition, Laffer's argument may be more compelling when considering countries with much higher tax rates than the United States. In Sweden in the early 1980s, for instance, the typical worker faced a marginal tax rate of about 80 percent. Such a high tax rate provides a substantial disincentive to work. Studies have suggested that Sweden would indeed have raised more tax revenue if it had lowered its tax rates.

Economists disagree about these issues in part because there is no consensus about the size of the relevant elasticities. The more elastic that supply and demand are in any market, the more taxes in that market distort behavior, and the more likely it is that a tax cut will raise tax revenue. There is no debate, however, about the general lesson: How much revenue the government gains or loses from a tax change cannot be computed just by looking at tax rates. It also depends on how the tax change affects people's behavior.

---

For related posts, click here and here. And here is James Gwartney on the topic.

Rubin on the Hot Seat

Shiller on Inequality

Just to be clear: I do not endorse this proposal. But if you think it is the role of government to contain inequality, then you have to admit that the Shiller plan has a certain logic to it.The IRS should be instructed to automatically adjust tax rates to keep economic inequality from getting worse, according to a new proposal outlined by Robert Shiller, a Yale University economics professor.

"We have a serious problem, and it's a problem of growing inequality," Shiller said on December 6 at a Library of Congress discussion in Washington. Shiller developed the proposal with Len Burman, director of the Tax Policy Center, and the two are planning to write a book on the idea.

"We need a standard or principle of income inequality. We don't have one now," he said. Inequality provides motivation to work harder and benefits hard work, hesaid, so "we do want some inequality, but we don't have any clear idea about where we're going and what is appropriate."

The standard, which Shiller calls "inequality indexation" of the tax system, would instruct the IRS to adjust brackets and rates whenever inequality worsened beyond an agreed-on level.

Update: Here is the Shiller paper.

Wednesday, December 6, 2006

Card on Income and Substitution Effects

I am not convinced that David is right. Here is the key question: When evaluating the effects of high taxes in Europe, compared to lower taxes in the United States, do we want to include both income and substitution effects, as David suggests, or just substitution effects?Region: As you may know, Ed Prescott has argued that different tax rates on labor in the United States and Europe explain why Europeans work fewer hours than Americans. Do you accept that explanation?

Card: I think that taxes could be part of the story. I would be surprised—given what I think is the credible range of estimates for the elasticity of labor supply—that tax differences are big enough to really explain the whole story.

It is conventional in one school of macroeconomics to assume that the elasticity of labor supply is quite high. And for some purposes that assumption may be correct. In thinking about responses to intertemporal or short-run shocks, for example, it is possible that the relevant elasticity is higher than labor economists have been able to estimate with conventional data and methods. A lot of work in the last 20 years has shown that the actual responsiveness of individuals to short-run fluctuations in wages may be bigger than the conventional estimates from the literature in the 1980s. Nevertheless, for the issue of taxes, we're really concerned about the long-run labor supply elasticity, which includes both the so-called substitution effect, representing the pure price effect of the higher wage, and the income effect. Those two go in opposite directions.

I believe that many labor economists in the United States—starting with H. Gregg Lewis, who was the intellectual father of modern labor economics—would agree with the view that in the long run the income effect dominates the substitution effect, so that over time, as societies become richer, people work a little bit less.

Region: They want more leisure.

Card: Yes, on average. That conclusion would be consistent with the long-run pattern of labor supply in the United States between 1890 and 1990. And in that case, one would normally assume that higher taxes [mean] lower wages and lead to a bit more work. That would have been my starting presumption, to tell you the truth: that the long-run labor supply elasticity is pretty small, and probably negative....

My own view would be that the plausible elasticity is not very big and that therefore the tax explanation won't go too far. But I don't want to get in a fight with Ed Prescott. After all, he's got a Nobel Prize and I don't [laughs].

The answer, I believe, depends on what happens to the tax revenue. If the tax revenue is wasted, then high tax rates are like low wages, and David is right. But suppose, more realistically, that the tax revenue is in effect rebated lump-sum to the taxpayers through a variety of entitlement programs (such as national health insurance). Then we are left with only a substitution effect. In this case, the effect of high taxes on the quantity of labor supplied is larger.

So I am more inclined to agree with Ed Prescott here. But I don't want to get in a fight with David Card. After all, he's got a John Bates Clark award and I don't.

Update: I emailed David to see if he wanted to comment, and he sent me this reply:

As my colleague Robert Barro pointed out to me, "Card is more likely to be correct the closer government expenditure is to being useless and vice versa for Prescott. Something of a role reversal."Thanks Greg. I am aware of Prescott's argument that the money collected in taxation goes back to the workers so the right analysis is one that ignores the income effect.

I don't think that is the right story myself: what fraction of the extra taxes that european workers pay do you think they view as yielding a rise in net income? My feeling is closer to 0 than 100%, but I can understand the alternative opinion. In that case, of course, the "cost" of bigger government is much smaller.

Call for Questions

What questions would you like to see posed to a random sample of PhD economists? Offer your proposals in the comment section, and Professor Whaples can cull the best ones. (Please, no snarky suggestions--unless they are particularly witty!)

Shlaes on the Pigou Club

Update: Felix Salmon weighs in with some good points.

The Looming AMT Problem

From today's Wall Street Journal. For more on the AMT, click here.

From today's Wall Street Journal. For more on the AMT, click here.Update: Here is Alan Viard on the topic.

Tuesday, December 5, 2006

Define "Rich"

So, from a global perspective, if you have net worth of more than $61,000, you are rich.The richest 2% of adults in the world own more than half of global household wealth according to a path-breaking study released today by the Helsinki-based World Institute for Development Economics Research of the United Nations University (UNU-WIDER).

The most comprehensive study of personal wealth ever undertaken also reports that the richest 1% of adults alone owned 40% of global assets in the year 2000, and that the richest 10% of adults accounted for 85% of the world total. In contrast, the bottom half of the world adult population owned barely 1% of global wealth.

The research finds that assets of $2,200 per adult placed a household in the top half of the world wealth distribution in the year 2000. To be among the richest 10% of adults in the world required $61,000 in assets, and more than $500,000 was needed to belong to the richest 1%, a group which — with 37 million members worldwide — is far from an exclusive club.

A Few Things to Read

- Thomas Sowell on Hollywood.

- Allan Meltzer on Milton Friedman.

- Joe Stiglitz on Ned Phelps.

- Ken Rogoff on Latin America.

- Glenn Hubbard and John Thornton on regulating capital markets.

Brink on the Brink

Brink Lindsey, the very smart vice president for research at the Cato Institute, wonders whether liberals and libertarians can find common ground in a newly revived Democratic Party. Personally, I am skeptical. For the Lindsey plan to work, the economic centrists among the Dems, including luminaries Bob Rubin, Larry Summers, and Jason Furman, would have to lead the way. My sense, however, is that they are now losing to the economic populists who prefer to bash Wal-Mart and obstruct free trade. But if the tide turns and the DLC crowd starts gaining ground, the libertarians could well jump ship from the Republicans. [How's that for a mixed metaphor?]

In any event, in the process of weighing these issues, Brink submits his application for the Pigou Club:

Tax reform also offers the possibility of win-win bargains. The basic idea is simple: Shift taxes away from things we want more of and onto things we want less of. Specifically, cut taxes on savings and investment, cut payroll taxes on labor, and make up the shortfall with increased taxation of consumption. Go ahead, tax the rich, but don't do it when they're being productive. Tax them instead when they're splurging--by capping the deductibility of home-mortgage interest and tax incentives for purchasing health insurance. And tax everybody's energy consumption. All taxes impose costs on the economy, but at least energy taxes carry the silver lining of encouraging conservation--plus, because such taxes exert downward pressure on world oil prices, foreign oil monopolies would wind up getting stuck with part of the bill.Welcome to the club, Brink.

Monday, December 4, 2006

Minimum Wage Research

Addendum: The CBO releases a study of low-wage labor markets.

Do econ students respond to incentives?

The Hamilton Project, an initiative at the Brookings Institution, will begin awarding a new prize, "The Hamilton Project Economic Policy Innovation Prize," to select graduate and undergraduate students for innovative economic policy proposals....The top undergraduate student will be awarded $10,000 and the top graduate student $15,000.

Update: Here, from the Independent Institute, is an essay contest for students and junior faculty on the topic, “Is foreign aid the solution to global poverty?”

Update 2: And here is an Economic Communicators Contest aimed at assistant professors, graduate students, and high school teachers.

From the University of Chicago

- Gary Becker and Richard Posner discuss students loans.

- Richard Epstein defends big pharma.

A new way to multiply...

Sunday, December 3, 2006

Economist Politicians

My first reaction to reading this letter was a question: Is the premise true? Are economists unlikely to enter electoral politics? I am not so sure. There are some successful politicians who started life as economists--Paul Douglas, Phil Gramm and Dick Armey, for example.Dear Professor Mankiw,

I am a Freshman at the Indiana University Kelley School of Business. I'm currently taking an introductory microeconomics course and reading from your textbook. Above all this course has taught me that economists are extremely skilled at examining real world issues and probably even better at clearly communicating their findings. I'm curious to know why I don't see more professional economists entering the world of politics as electable candidates.

Thank you,

[name withheld]

Moreover, economists are relatively rare in the overall population, so you would expect them to be rare in any subpopulation, such as politicians. Let's put some numbers to this. Only about 1000 econ PhDs are awarded each year, and only about half these are U.S. citizens (source). There are about 4 million Americans born each year. As a rough approximation, therefore, only 1 in 8000 Americans would likely qualify to be called a professional economist by training. There are 535 members of Congress. If economists had an average rate of entering politics, the probability that Congress at any moment would include an economist would be about 7 percent. I think that we economists do better than that: otherwise, the event of having two in Congress at the same time (Gramm and Armey) would be very unlikely.

My second thought is that if I were a young person planning a political career, I would not start by becoming a professional economist. An undergraduate degree in economics is ideal, as it teaches a lot about the fundamentals of public policy, but an aspiring politician would find it unnecessarily costly to spend the 5 or 6 additional years typically necessary for a PhD. A law degree is much easier. It is also more diversifying as an educational experience once one has studied econ in college for four years. The same is true of an MBA or a master's in public policy. The specialized technical and research skills taught in econ grad school are not needed, or even particularly helpful, for a successful political career.